Photo by Andre Taissin on Unsplash

Photo by Andre Taissin on UnsplashDo you find yourself in a constant cycle of being broke? Does this sometimes get in the way of you enjoying life?

As someone who has had to live on a tight budget during and after college, I understand how stressful it can be to feel like you can't afford the things you would like to buy.

The following tips will help ease this stress and give you some ideas on how to cut back on spending.

Be Aware of Your Budget

The first step to living on a tight budget is actually being aware of your total income and how much of it that you actually need to spend.

Find your total income for the month.

Add up all income you normally get, which can include side hustles, monetary help from others, and financial aid from school. If your income varies from month to month, make a general estimate to get an idea.

Find the Total of Your Average Expenses for the Month

These expenses should include fixed expenses, which are expenses that are the same every month.

Some examples of fixed expenses may include:

rent or mortgage

car payment

insurance

internet bill

Your list of expenses will also include expenses that vary.

Some examples of expenses that vary may include:

groceries

eating out

shopping

Photo by Nathan Dumlao on Unsplash

Photo by Nathan Dumlao on UnsplashKnoweldge Check

Each of these scenarios shows how some make their monthly budget:

Anthony makes a list of his fixed expenses, then he swipes his credit card every time he goes to the local bar with his friends.

Beatrice lists out all of her fixed expenses, and then takes a look at her previous bank statements to see the average of her expenses that vary.

Cathy includes her average expenses that vary each month into her budget. After she includes her expenses that vary, she sees how much she has left for her fixed expenses.

Quiz

Which person above shows the best way to find your budget?

Subtract Your Total Expenses from Your Total Income

After calculating your total income and expenses for the month, see what the difference is that you come up with. You have a balanced budget when you find the difference in your total income and expenses for the month to be 0.

Of course, it's always ideal to get a positive number so that you're spending less than you make. If you're spending more money than you make and you come out negative, you'll need to see where you can make some cuts in your expenses.

See Where You Can Make Small Cuts

Can you make some small changes to any expenses that will save you more money?

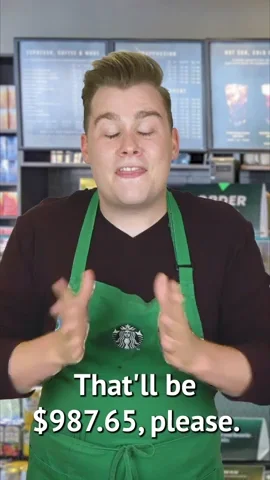

When I made a spreadsheet of how much I was spending, I noticed that I could cut back on how many times I went to Starbucks.

Ideas on some small cutbacks that you can make:

Make your own coffee instead of going to fancy coffee shops.

Make a list before going to the grocery store. This will help you stick to what you need without overspending.

See if you can take on a side hustle. Can you walk dogs? Tutor?

Make Room for Extra Spending

Living on a tight budget can be hard. You should be able to give yourself a small amount to spend on something fun and stick to that budget.

Having a small amount for you to make a little splurge will help you stick to a budget without total deprivation.

Take Action

Photo by Brett Jordan on Unsplash

Photo by Brett Jordan on UnsplashIf you're ready to live better on a tight budget, take these next steps:

Your feedback matters to us.

This Byte helped me better understand the topic.