Money is a possession, like the clothes on your back, the shoes on your feet, or the books on your shelves.

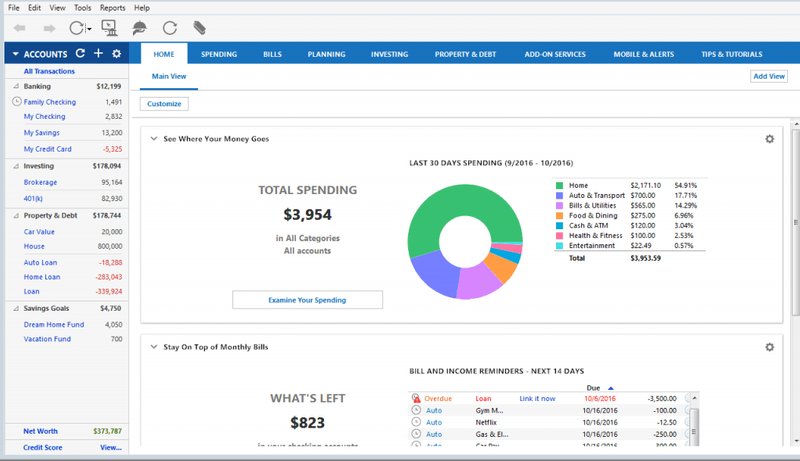

It's easy to keep track of clothes and shoes: just look in your closet. Wouldn't it be great to see your money organized, just like folded shirts?

Fortunately you can! And once you have your money organized you can track your spending - the key to reaching your financial goals.

Step 1: Know Your Needs

When looking at software options for tracking your financial health, the first thing you need to do is understand your needs. Are you:

A small business owner?

A non-business owner with a simple financial profile? I get, spend, and save money.

A non-business owner with with a moderate financial profile? I get, spend, save, and sometimes invest money.

A non-business owner with an advanced financial profile? I get spend, save and invest money. Plus I manage it online.

Quiz

Jamie runs a local flower shop and manages her family's household expenses. Which of these best describes her financial profile?

Step 2: Know Your Budget

How much are you willing to spend on tracking software?

Most online tracking tools are priced for subscriptions

Small businesses and individuals with advanced financial profiles may need to pay for additional features

Non-business owners may be able to use free services (or even a simple spreadsheet)

Cloud based software can speed up your tracking by automatically pulling in data from your online bank accounts. If you don't wish to have your data connected this way, you can opt for files to be stored locally on your computer.

Use your answers to choose the right tracking software for you.

Step 3: Stick To A Plan

You've assessed your needs, budget, and have picked a tracking tool.

Now the key: sticking with it.

Any tool loses its value if you don't use it. The good news is, setting everything up at the beginning is the hardest part. Set aside 30 minutes each week aside to review your file:

Is everything up to date?

Do I need to add any expenses?

Do I need to adjust any income?

Is there any big expenditure on the horizon I have to plan for?

Quiz

Which of these are good habits when using financial software?

Take Action

Over the next week, make it a goal to start with Step 1 in this Byte. Steps 2 and 3 will come easily after that.

Your feedback matters to us.

This Byte helped me better understand the topic.