Do you want to become a Chartered or Certified Public Accountant (CPA) but don’t know how to get started?

CPAs don't just punch numbers into a calculator all day. They support individuals and businesses by helping them with important finance-related tasks.

It will take some hard work and dedication on your part, but there's a clear path to accomplishing your career goals. Learn about the “three E’s” to begin or complete your career journey.

Education

First, earn your high school diploma or GED.

Next, complete a 4-year bachelor's degree, with at least 150 credit hours , from an accredited university. The number of hours required for each course varies by state and territory.

Photo by Brett Jordan on Unsplash

Photo by Brett Jordan on UnsplashAlthough most CPAs have a degree in accounting, it's still possible to become a CPA with a bachelor’s degree in another field . You'll have to complete additional undergraduate courses to meet the education requirements in your region. You can expect to take courses such as:

Financial Accounting

Managerial Accounting

Financial Accounting Theory and Practice

🍁 If you live in Canada, click here to learn about the education requirements for CPAs who practice in Canada.

Experience

Most regions in the US and Canada require CPA candidates to have atleast two years of public accounting experience verified by a licensed CPA. Your experience should include work in accounting, attestation, auditing, or taxation.

Other states acknowledge work in government, industry, and college teaching as professional experience.

Some states and territories accept part-time work and volunteer experience.

Click here to view US state and territory requirements.

Click here to view the requirements in Canada.

Photo by Tim van der Kuip on Unsplash

Photo by Tim van der Kuip on UnsplashExam

CPAs must be licensed in both the US and Canada. To gain licensure, you're required to pass the CPA Exam in your country. Most regions require CPA candidates to complete a nationally recognized certifying exam. These exams are rigorous, so you should begin test prep as soon as possible.

US candidates take the Uniform CPA examination. This assessment:

Has four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG)

Consists of multiple choice and written questions

The CPA exam in Canada is called the Common Final Examination (CFE). The CFE:

Is taken over three days

Covers skills defined by the CPA Competency Map

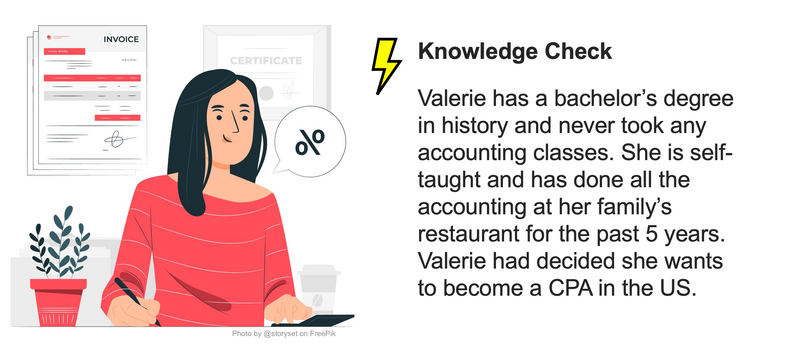

To access the audio transcript of the text from the image above, press the play button below:

Quiz

Can Valerie become a CPA by passing the licensure exam?

Additional Skills

The purpose of the three E's (education, experience, and the exam) is to help you develop the skills critical to being a successful CPA. These skills include:

Tax knowledge

Business acumen

Strong communication skills

Technical abilities

Leadership capabilities

To ensure their knowledge is up to date, CPAs continue to sharpen their skills long after they've passed the licensure exam.

Advice From a Pro

Here’s what they won’t tell you in college, or even in your first job: You’re an entrepreneur. Learn to think like an entrepreneur. Learn to act like it.

Bottom line: Every accountant is in business for themselves, responsible for their own skills, growth, integrity, reputation, brand, and service to clients and the public. The most important skill you can learn beyond the basics for licensure are how to get new clients, and to amaze and delight them.

-- Rick Telberg, Founder and CEO, CPA Trendlines

Being a CPA requires you to be highly self-motivated. You'll also need to connect with people and gain their trust. As you study tax laws and auditing systems, brush up on your soft skills, too.

As Rick Telberg states, CPAs are responsible for their own professional development and branding. Stay focused. Stay consistent.

Take Action

Your feedback matters to us.

This Byte helped me better understand the topic.