It's officially that time of the year.

Not Christmas. Not the Super Bowl. Not Black Friday. It's time to file a tax return. In America, tax season kicks off on January 1 and runs through April 15 every year.

For some Americans, this is a sense of irritation. Other Americans might go through a feeling of dread and gloom.

It's understandable. Filing a tax return can be tricky and nerve-wracking. Learn tips to make it less scary and intimidating!

What is a tax return?

An income tax return is a form that people complete to report to the IRS how much money they earned, any expenses, and how much taxes they paid that year.

Things get tricky when it comes to who receives a refund from the government, or who owes money to the government.

You'll receive a refund if you overpaid taxes. You'll owe if you don't pay enough taxes throughout the year. However, some people don't receive or owe any money.

Am I required to file?

It depends. Not all Americans are required to file an income tax return. You'll need to know the following information to determine if you have to file:

Filing status (single, head of household, married, qualified surviving spouse)

Gross income (all income you received for the tax year in question)

You can determine if you have to file by using this interactive tool provided by the IRS.

What do I need?

To file an income tax return, you'll need your financial documents and personal information.

Don't think you'll need to provide every financial document you've received over the past year! The IRS is only looking for certain information, primarily your sources of income throughout the year.

Main financial documents needed:

W2: Provided to hourly or salaried employees by any employer.

1099-NEC: Provided to gig workers (think DoorDash or InstaCart) or freelancers from companies they have contracted with.

You should receive these from your employer or company you contracted with by mail or email.

Other financial documents you may receive:

1099-INT: Provided by financial institutions (banks, credit unions) if you've made over $10 in interest.

1099-DIV: Provided by a brokerage firm if you received over $10 in dividends.

Now that you know the financial documents needed, you need to gather the personal information required to file.

Personal information needed:

Legal name

Address

Social security number

Account and routing numbers for your preferred financial institution (if you have to pay or you receive a refund)

Which deductions do I take?

You also need to know about deductions. They decrease how much your income is taxed. With deductions, you have two options: itemized or standard.

Itemized deductions:

An expense that can be subtracted from adjusted gross income to reduce your tax bill.

The following can be deducted:

Medical expenses

Mortgage interest

Charitable contributions

State and local taxes

The itemized deductions have to meet a certain amount for you to be able to claim them, so not everyone will qualify for this option. This option is also more time-consuming compared to the standard.

Standard deduction:

A standard deduction is an amount set by the government that can be subtracted from your taxable income. This amount is adjusted for inflation every year.

With this option, you don't have to keep track of all expenses like you would with the itemized deduction. It's also a faster process.

The real question is which one will benefit you when you file your income tax?

You should consider taking the standard deduction if your itemized deductions are lower than the standard deduction ($14,600 in 2024).

Remember: you can only choose one deduction, so choose the one that is the most beneficial for you.

Help...I have to file!

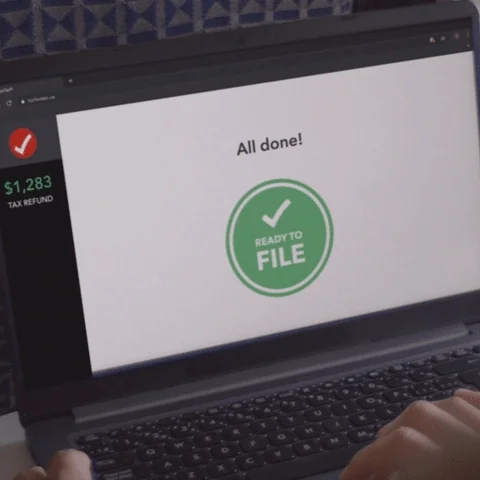

So, you did the calculations and you have to file. It's okay! Filing an income tax return doesn't have to be scary. There are options available to make the process as easy as possible — but the costs vary:

Use professional tax services that will prepare your income tax return for you. This will likely be your most expensive option.

E-file with tax preparation programs that will walk you through the process. The cost varies by program and income.

DIY. The IRS offers free fillable forms on their website. However, you won't be walked through the process, so be careful if you choose this option! You don't want your return rejected.

Do these options apply to state income tax returns?

If you live in a state that requires you to file an income tax return, you need to consider that as well. Professional tax preparers and online tax preparation programs will submit state income tax returns for you.

However, if you choose to use the IRS fillable forms on their site, you'll have to find another option to complete your state return.

Quiz

Miranda is filing an income tax return for the first time. She wants the easiest, cheapest way possible to submit her federal and state income tax return. Which option should she choose?

Take Action

Filing an income tax return can be daunting and scary, but it doesn't have to be. With the right tools and preparation, filing your income taxes will be a breeze.

Your feedback matters to us.

This Byte helped me better understand the topic.