Credit is the likelihood someone will repay money borrowed today, at a later date. This is often measured using a credit score.

A credit score is a number roughly between 300 to 900. It's created by collecting specific information about your financial behavior. This varies from country to country.

This number is used by many organizations to measure if you are financially responsible and can be trusted to repay loans or bills.

This number is used by many organizations to measure if you are financially responsible and can be trusted to repay loans or bills.

Mortgages, loans, and credit cards. With better credit, you get lower interest rates

Insurance companies. With better credit, you get cheaper policies

Landlords and employers. With better credit, you show you are responsible.

Credit Score

Let's break it down:

Different financial activities can have a high or low impact on your credit score.

High Impact Activities

Credit Card Use - the percentage of your available credit are you using. You want to use some but not all. If you have a $1000 credit card limit and have used $300 seen on your bill, that is 30% utilization. Low Utilization is better.

Payment History - do you pay your bills on time? Set up auto-payments to avoid late or missed payments. Consistent on-time payments are very important.

Derogatory Marks - failure to pay back a loan, foreclosures, payments more than 30 days late, or bankruptcy can stay on your account for 7 to 10 years.

Medium and Low Impact Activities

Age of Credit - length of time you have had an account. The longer you've been building good credit, the better.

Total Number of Accounts - this includes any services that issue credit to you like a student loan or a phone plan. Having more accounts is better, as long as they are well managed.

Credit Inquiries - There are 2 types:

Hard Inquiries - like applying for a credit card, appear on your credit history.

Less Hard Inquiries are better. They stay on your record for 3+ years.

Soft Inquiries - like checking your credit report, do not appear on your credit history.

Quiz

Mahmoud has: 100% payment history, 12 accounts, and a 7 year old credit card. How would you describe his credit

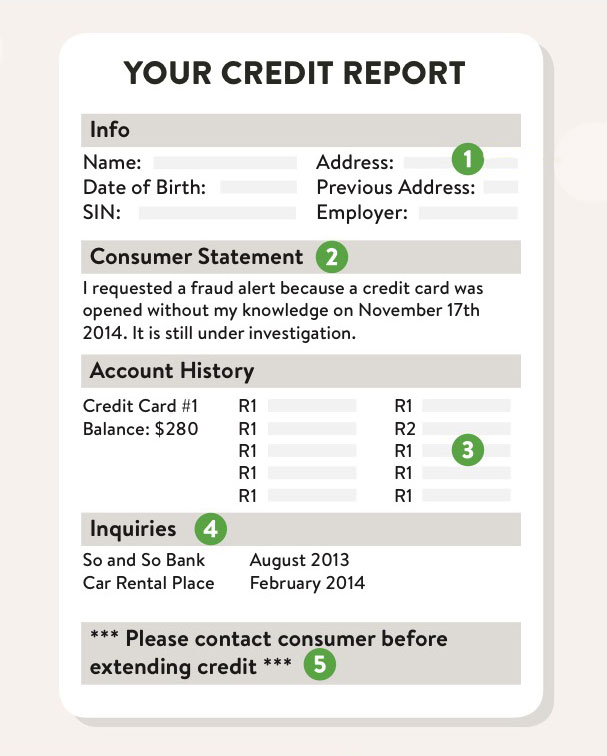

Credit Report

This is a formal record of your credit history and includes the information available when someone checks your credit.

A Credit Report can be obtained through a few companies, including Equifax, Experian, and TransUnion, in Canada and the USA, these companies must legally give you a free report every 12 months.

*Set a calendar reminder to check your credit annually. Being informed can help identify errors impacting your score, identity theft, and help you decide how to improve your score.

If there is an error you can contact the companies to update the information.

Impact Of Credit On Your Life

Looking at this Car Loan Scenario we can better understand the impact of Credit Scores?

Lee

Age: 24

Income: $40,000 per year

Credit Score: 620

More risk

Has many late payments

Maria

Age: 24

Income: $40,000 per year

Credit Score: 760

Appears reliable

No late payments

Lee and Maria each want a car loan for 12,000 dollars.

They each go to the same lender and get approved for a 5-year loan.

Credit Score

Lee - 620

Approved Interest Rate

12%

Monthly Payment

$266.93

Interest Paid Over 5 Years

$4,016

Credit Score

Maria - 760

Approved Interest Rate

3%

Monthly Payment

$215.62

Interest Paid Over 5 Years

$937.46

From this scenario, we can see that bad credit has a large financial impact. Lee will pay almost $3000 more than Maria for the same service.

Quiz

Based on this scenario what can Lee do to improve their credit score to get a better rate?

Take Action

Can you answer these questions about credit?

What is a credit score?

Why is it important?

What actions can take to increase your credit score?

How often can a free credit report can be legally requested in Canada or the USA?

Have you checked your credit score and looked at your credit report this year?

Being informed is your best tool for financial success.

Check out other Bytes related to improving your credit score!

Your feedback matters to us.

This Byte helped me better understand the topic.