This logo isn't an ad or affiliate link. It's an organization that shares in our mission, and empowered the authors to share their insights in Byte form.

Rumie vets Bytes for compliance with our

Standards.

The organization is responsible for the completeness and reliability of the content.

Learn more

about how Rumie works with partners.

Picture this... 💭

One day a student comes to you, looking extremely stressed and says:

"The Taylor Swift concert is coming up, and I'm going to take all my savings out of my bank account to pay for it!" 😭

You realize this is a great opportunity to teach your students some life-changing money tips, but... where should you begin?

Discover key money concepts you can teach your students so they make smart money decisions, have less stress, and achieve financial stability.

Ready to make an impact in your student's lives? 📈

Why Does Understanding Money Concepts Matter?

So, you're excited to teach your students about money concepts, but you're not sure how to convince them that it's important.

First, help your students understand why knowing about money concepts — also known as financial literacy — is important for their lives.

You can do this by sharing these important tips with your students:

1. Avoid costly mistakes.

Knowing how money works can prevent your students from making decisions that could hurt their pockets in the long term or impact their life plans.

Example you can share with your students:

Imagine one of your students is thinking of getting a phone plan with a low monthly payment, but it has high interest rates if they forget to make a payment.

By knowing this, they avoid extra costs that could ruin their monthly budget.

2. Handle emergencies.

Financial literacy helps your students to prepare for unexpected situations, like losing a job or facing a big surprise expense.

Example you can share with your students:

A student is working on a project and their laptop suddenly breaks. The project is due in 2 days, so they need a new laptop fast.

If they’ve been saving money regularly, they can buy a new laptop without stressing out about how to pay for it.

3. Reach goals.

By learning how to budget and save, your students can create a plan to reach their financial goals.

Example you can share with your students:

If a student wants to buy a ticket for a concert, knowing how to save money each month can help them afford it, even if they can’t buy it right away.

4. Feel confident.

When students understand money concepts, they can make decisions with more confidence because they'll be less stressed about things potentially going wrong.

Example you can share with your students:

Imagine a student is deciding whether to buy the new iPhone or save the money for a summer trip with their friends.

They confidently choose to save the money because it means they'll be prepared for any unexpected costs during their trip.

What's important is that your students understand that "being in good financial health doesn’t mean being rich". 📍

It's about knowing their personal situation and having a plan to improve it.

Money Concept 1: Budgeting

What is budgeting?

Budgeting is planning how to use your money.

It helps your students know how much money they have, what they need to spend it on, and what they can save for things they want or may need in the future.

To teach your students to budget effectively:

1. Ask them to think about their short-term and long-term goals.

Tip: Teach your students how to break down their goals into doable steps like setting a monthly (e.g. $100) or weekly ($25) savings target to reach their desired amount within a specific timeframe (e.g. 5 months). 📍

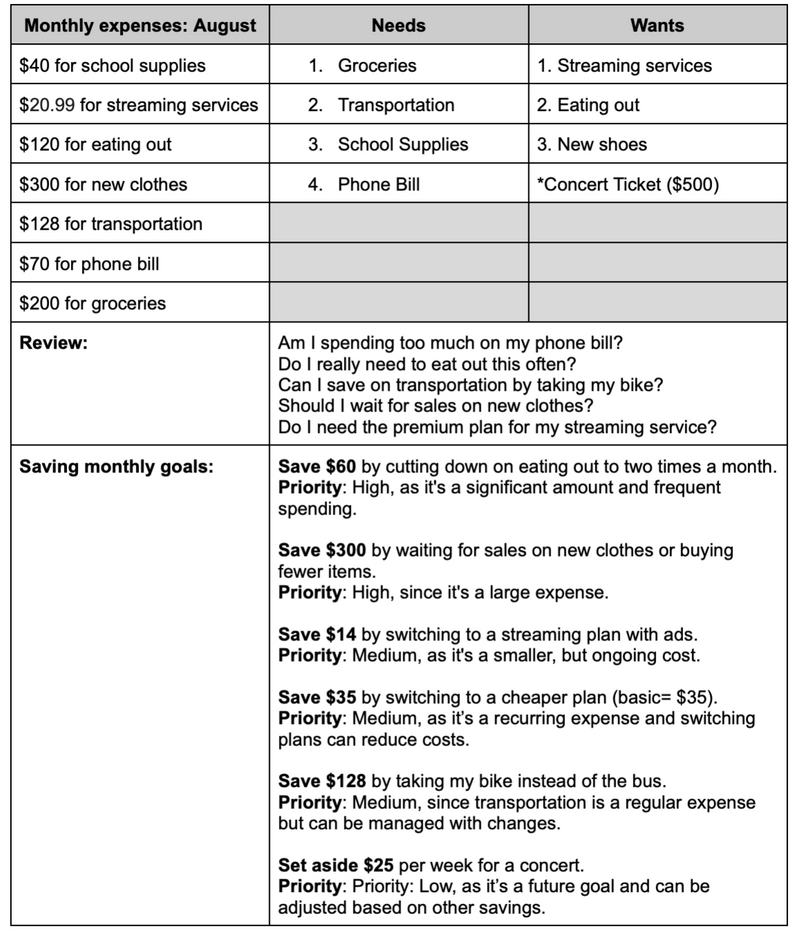

2. Guide them to figure out their needs vs wants.

Tip: Teach your students how to make a “Needs vs. Wants” list. 📍

Like this one:

To hear an audio version of the information in the table above, click the play button on the three audio players below:

To hear an audio version of the information in the table above, click the play button on the three audio players below:

Part 1 — Mostly Expenses, Needs and Wants:

Part 2 — Review:

Part 3, Saving Monthly Goals:

3. Encourage them to track their income, savings, and expenses.

Tip: Teach your students how to use financial tools and calculators like a budget planning tool to make a personalized budget and get tips and advice about how to manage their money. 📍

For Canada: Financial Consumer Agency 🇨🇦

For the US: Nerd Waller 🇺🇸

Money Concept 2: Debt Management

What does understanding debt responsibly mean?

Understanding debt responsibly means your students know how their credit score affects interest rates and understand the terms of their debts.

It also means making a plan to pay off debts and knowing the difference between good debt and bad debt.

To help your students make a debt management plan:

1. Ask them to make a list of all their debts.

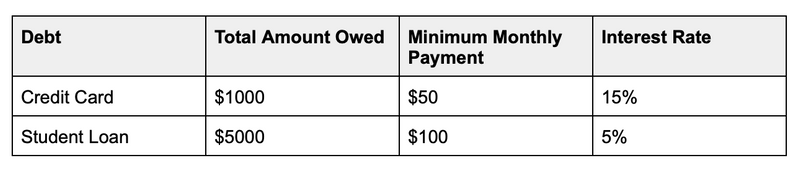

Tip: Teach your students how to use a debttable like this one: 📍

To hear an audio version of the information in the mind map above, click the play button on the audio player below:

2. Encourage them to review their budget.

Tip: Teach your students to put their needs before their wants and try reducing their expenses. 📍

Example you can share with your students:

If their budget shows they earn $1,200 a month and spend $900 on essential needs, and $80 on takeout and streaming (aka wants), they can cut these extra costs and use the savings to pay off debt faster.

3. Show them how to choose a timeframe.

Tip: Teach your students to have a timeframe that is reasonable and affordable. 📍

Example you can share with your students:

If they owe $500 on their credit card, they can pay $100 a month for 5 months.

Or they could pay $50 a month for 10 months. Just remind them that the longer they take, the more interest they may pay.

4. Guide them to decide which debts to pay off first.

Tip: Encourage your students to focus on paying high-interest debts first to save money and be debt-free faster. 📍

Example you can share with your students:

If they have a $500 high-interest payday loan and a $200 lower-interest credit card debt, it's better to pay off the payday loan first.

They can make minimum credit card payments and use extra money for the loan, saving on interest.

If they owe money to family or friends, suggest setting up a payment plan with automatic payments.

5. Let them know where to get help.

Tip: Shareresources with your students if they struggle with debt. Remind them not to wait too long to seek help. 📍

For Canada: Credit Counsellors & Licensed Insolvency Trustees 🇨🇦

For the US: Federal Trade Commission & Consumer Financial Protection Bureau

Money Concept 3: Emergency Funds

What is an emergency fund?

An emergency fund is money you save for unexpected situations like car repairs, a job loss, or sudden health problems that stop you from working.

Since emergencies can happen any time, having a fund ready helps students to handle them without going into debt.

To help your students start building an emergency fund:

1. Suggest they open a savings account.

Mention that this account needs to be easy to access in emergencies and separated from their daily spending.

Tip: Show your students how to use an account comparison tool to find the best account for their needs. 📍

For Canada: Financial Consumer Agency 🇨🇦

For the US: Bankrate & Nerd Wallet 🇺🇸

2. Encourage them to start small.

It can take your students a long time to build a large emergency fund, so saving a small amount regularly helps it grow and keeps them motivated.

Tip: Encourage your students to save 3 to 6 months of their regular expenses or their income.📍

3. Guide them to automate their savings.

Show your students how to set up automatic transfers from their main account to their emergency fund.

Tip: Encourage your students to schedule transfers right after they receive their paycheck so their money is saved before they can spend it. 📍

4. Remind them to keep it for emergencies only.

If they aren't sure, suggest they check if the expense is planned or unplanned.

Tip: Before using the fund, encourage your students to ask themselves if this expense can wait or if it’s something that was already in their budget. 📍

5. Encourage them to increase their emergency fund.

They can add extra money whenever possible, such as from tax refunds, bonuses, pay rise, or money gifts.

Tip: Encourage your students to put the money they were using for loan payments into their emergency fund once they've pay off the loan. 📍

Quiz

Imagine a student received a $300 gift for their birthday and wants to use this money wisely but they aren't sure how. What advice would you give them?

Splitting the money for debt, an emergency fund, and a planned expense is the best way to use it wisely since it covers different financial goals. Saving it all might not address other needs or wants, spending half on a need and half on a want doesn’t cover all important goals, and using it all up isn’t the best approach for long term financial stability.

Take Action

Guide your students to understand money concepts and take control of their finances:

This Byte has been authored by

Ana Esparza

Learning Designer

M.Ed.