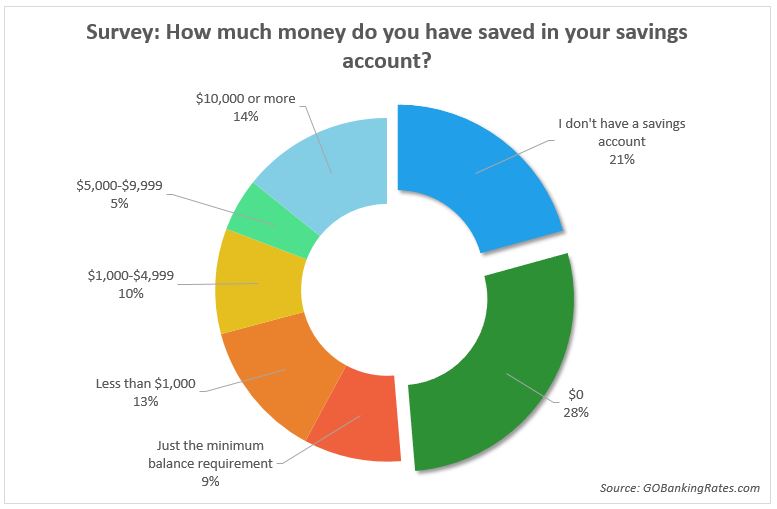

40% of Americans admits to having $400 or less in their savings accounts.

Without extra money in savings, just one accident or unexpected expense can be a financial disaster.

Financial security starts with getting organized and understanding your financial health.

Key Attributes of Financial Health:

Having an organized view of your assets & accounts

Understanding your liabilities & debts

Staying on top of your Income (money in) & expenses (money out)

Gather Your Financial Information

Photo by Unseen Studio on Unsplash

Photo by Unseen Studio on UnsplashIdentify all of your accounts. Checking, Savings, Investments, Credit Cards, etc.

Verify all income is documented and received in the correct account(s).

Create a list of all of your expenses.

Consider potential taxes. Are any of your expenses eligible for a tax credit? Should you be saving any income to pay future taxes?

Schedule one hour each month to review this information.

Analyze Your Financial Information

Calculate how much cushion you have left over in accounts after all monthly expenses. Do you have at least 3-6 months worth of necessary expenses set aside for emergencies?

The "50/30/20" budget guidance suggests your income should be spent 50% on needs, 30% on wants, & 20% to payoff off debts/adding to savings. What is the current breakdown of your income today?

Do You Need To Take Action?

Your answers to these questions may uncover some opportunities to improve your financial health.

If the answers leave you feeling uneasy, consider what non-essential expenses you can cut.

If the answers leave you feeling good, congrats! Do this financial health check monthly to stay on track.

Take Action

Photo by Kelly Sikkema on Unsplash

Photo by Kelly Sikkema on UnsplashGrab your calendar right now!

Book in some time to do your first financial health check.

Your feedback matters to us.

This Byte helped me better understand the topic.