Tired of living paycheck to paycheck? Want to save for a big item? Overwhelmed by debt? A budget helps you keep track of where your money is going and gives you more control over it.

There are a few ways to approach this task depending on your needs.

Method #1: Inflows = Outflows

Cash inflows - outflows = zero. What you earn is equal to what you spend each month.

Best For:

People who have a steady income each month or can accurately estimate their monthly income.

Process:

Compare your monthly income to your monthly spending. Make sure you prioritize your expenses. Set aside money for the most important expenses, such as rent, food, transportation, and healthcare.

Considerations:

You have no savings left, which is not desirable.

Consider putting your monthly expenses in a spreadsheet to keep track of them.

Method #2: Maximize Savings

Try to save as much as you can after your expenses.

Best For:

People who are focused on saving their income or repaying debt.

Process:

When you get a paycheck, first set aside a specific, pre-determined amount for savings and debt payments.

Considerations:

You may need to adjust your spending habits and focus on maximizing your savings.

As you reach your savings or debt repayment goals, you can adjust the monthly "set" amount to focus on other financial goals.

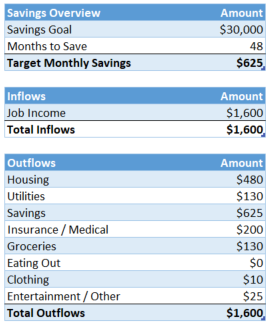

Example Budget:

Method #3 Debt Repayment

Key Concept:

Reduce or pay off your debt.

Best For:

People with outstanding debts.

Process:

Like the "Maximizing Savings" method, you might choose to put a pre-determined amount toward paying off your debt each month.

If you have multiple debts, focus on paying off the most expensive, high-interest debt first.

Considerations:

You need to track the interest rate on your all debt and rank them

Meet Gwen

Gwen works as a server and earns about $2,200 per month.

She has been trying to pay off her student loans and also wants to save to move into her own apartment.

Quiz

Which Budget Method is best for Gwen?

Take Action

Which method is right for you?

Your feedback matters to us.

This Byte helped me better understand the topic.